\ ˈlan-ˌyap , lan-ˈyap \

: a small gift given to a customer by a merchant at the time of a purchase; broadly : something given or obtained gratuitously or by way of good measure

Mardi Gras doubloons; Getty Images; undated.

Mardi Gras Doubloons are Priceless

When my brother and I were kids, going to Mardi Gras parades was beyond thrilling. Random strangers were throwing all kinds of free toys and "priceless" coins (doubloons) to us and the frenzied crowds along the parade route. The hot items every year were glass beads (very rare), painted coconuts, and doubloons.

Doubloons are usually made of aluminum, look like large coins and come in a variety of styles and colors. They are actually hard to catch or retrieve because they roll when they hit the ground. So, suffice to say there was a lot of chasing, collecting and trading of doubloons in the Jensen family.

Those doubloons remind me of crypto currency. There's almost no intrinsic value, but it's often treated like a priceless commodity.

Why is this? I'll answer that question and a bit more as we explore the basics of the emerging world of crypto.

NOTE: Tomorrow, Tuesday, 1 Mar, is Mardi Gras Day. Throw me something mister!

Cryptocurrency: The Basics

We hear so much about 'crypto' (short for cryptocurrency), it seemed appropriate to provide the basics of this emerging field, and to offer some important perspective for the long-term investor.

What is 'crypto'?

“Cryptocurrency” is a name given to a broad group of digital assets that started in 2009 with bitcoin. There are thousands, but only a dozen or so have any appreciable size and potential future. A tremendous amount of hype surrounds bitcoin with some claiming it will become the world's reserve currency. Others believe it is a fad or reminiscent of a Ponzi scheme.

Setting aside for a moment bitcoin’s fundamental value or functionality, the primary reason it matters is this: bitcoin allows any two people, anywhere in the world with an internet connection, to make a transfer of value in a few minutes without a middleman. Note: I'm using Bitcoin to represent all crypto currencies.

How does cryptocurrency work?

The basic idea is that cryptocurrencies operate on software networks, where a myriad of computers run separate copies of the same program. The computers are linked, but no one computer controls the network. In bitcoin parlance, it’s a “decentralized” network.

The computer networks have two main functions: One is to process transactions, the other is to maintain the database that records and stores those transactions. In general, transactions are batched into “blocks,” which are then connected in chronological order in a long, unbroken “chain.” This is why the software became known as “blockchain.”

Who controls the computers?

Anybody can download and run these software programs; they are “open source” programs. The database where transactions are recorded, usually called the ledger, is therefore visible publicly to anybody.

This ensures that nobody on the network is counterfeiting the currency or double-spending the same bitcoins. The transaction history is collectively agreed upon by every computer, so it cannot be changed later. Transactions are permanent.

How did this all start?

On Oct. 31, 2008, somebody using the pseudonym Satoshi Nakamoto released a nine-page paper describing a new system of “electronic cash” called bitcoin.

Bitcoin promised to be an alternative to the existing financial system, and it struck a nerve with a lot of people in the wake of the global financial crisis. “Bitcoin” became as much a social movement as a piece of technology. That’s one reason it has such a passionate following; crypto’s adherents believe they are willing a financial revolution into existence.

The first thing an inquisitive investor should do is read Nakamoto’s original “white paper.” It’s technical, but understandable, and it explains quite clearly how the bitcoin network operates.

How do I buy one?

Originally, the idea behind bitcoin was that you downloaded the software and ran your own version of it, “mining” new bitcoins yourself. You were your own banker, a “self-sovereign.”

In practice, however, that’s much too unwieldy—and expensive—for most people. The most common way to buy bitcoin now is through a crypto exchange like Coinbase or Gemini, or a mobile broker like Robinhood, PayPal or WeBull.

Exchanges and other intermediaries often act as custodians for your funds. This means they are responsible for safeguarding your account—to a degree. If you allow access to your account, in a phishing scam for instance, that person can drain your funds, probably permanently. In bitcoin, there is no way to reverse a fraudulent transaction.

What should I be concerned about and guard against?

A lot. Because crypto is a new area, and has largely been unregulated or only lightly regulated, cons and frauds are rife. The Federal Trade Commission warns investors to steer clear of any opportunities that promise you can earn lots of money in a short time, that ask you to recruit other investors, that offer guaranteed money or free money, or that make exorbitant claims with limited details.

In general, it’s best to steer clear of any investment offer via social media, especially if it comes to you. Naïve investors are scammed perhaps daily.

How do I make money?

Buying bitcoin is not like buying a stock or bond. When you hold bitcoin, you don’t own a piece of a company. You make money with bitcoin in one way: by selling it to somebody else for more than you bought it for.

An emerging part of the crypto market is called “defi,” short for decentralized finance. These are bank-like services that allow you to lend out or borrow against your crypto holdings. If you lend, you can earn interest that typically ranges from 5% to 20%. If you borrow, you can take the borrowed crypto and invest it elsewhere in the market, again hoping to sell it for more than you bought it for.

However, defi is a new field, with virtually no business standards. Almost once a week, there is a loss of funds. Very often, some malicious coder finds a flaw in a defi program and drains accounts. Sometimes, bad software crashes and erases transaction histories. Sometimes, the platforms were set up just to steal money (a “rug pull”). The research firm Elliptic estimates that about $10 billion has been lost in 2021 on defi platforms. This is a buyer-beware environment.

Ultimately, you may make a profit in crypto, but know that you are putting money into a largely unregulated area with a lot of opaque corners and volatility. The billionaire hedge-fund manager Paul Tudor Jones understood this when he got into the market, calling bitcoin “a great speculation.” That is about the best description of it I have heard.

Glossary

Cryptocurrencies: Digital tokens used to transfer money between individuals’ computers with minimal fees.

The blockchain: The simple, open-access ledger that underpins the currency. When a bitcoin owner transfers a token to another person, he or she posts the transaction to the blockchain, signing it with a unique string of numbers and letters. Even financial firms that are skeptical about bitcoin and other cryptocurrencies have embraced the blockchain technology itself.

Miners: Bitcoin “miners” verify transactions by running the numbers through formulas on high-powered computers.

Satoshi: One of the one hundred million units that make up each bitcoin. Also the first name of bitcoin’s alleged inventor, the mysterious Satoshi Nakamoto.

Defi: An abbreviation for “decentralized finance,” or banking services that allow investors to lend out or borrow against their cryptocurrency holdings.

Summary

Crypto is getting a lot of attention and requires significant understanding before investing. At this stage, it reminds me of a Mardi Gras doubloon: no intrinsic value, but to some people, it is priceless.

Do you have questions about crypto or your financial plan? Schedule a meeting so we can discuss and develop a highly personalized plan that meets your specific needs.

Laissez les bons temps rouler

NOTE: This article borrowed extensively from Paul Vigna's WSJ article: "What Is Cryptocurrency, and How Does It Work?" found HERE.

Mary's Recipe Corner

Enjoy this family recipe from Mary:

Chunky Applesauce

This is a simple, but tasty addition to almost any meal. For Christmas last year, our son gave me a much needed replacement to my apple peeler, corer, slicer. I have used my new fire-engine-red apple peeler, corer, slicer to make lots of apple sauce recently!

Ingredients:

- 4 Granny Smith apples (peeled, cored, and sliced - best achieved on a fire-engine-red apple peeler, corer, slicer) 😉

- 3 TBSP sugar (can adjust +/- a TBSP depending on your taste)

- 3/4 cup water

- 1/2 tsp cinnamon

Place bite sized apple pieces in saucepan along with the sugar, water, and cinnamon. Cover and cook on medium heat for 15-20 minutes. You can use a potato masher to make the applesauce smoother or leave as is for a chunky sauce. It can be served warm or refrigerated. Lasts several days in the refrigerator.

Blessings and bon appétit!

Mary

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it's appropriate to share a bit of art with our readers.

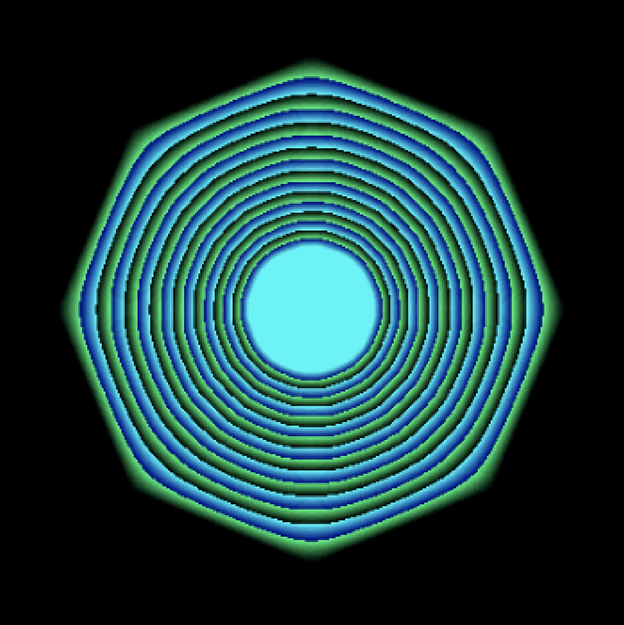

Similar to financial transactions, crypto has also found its way into the art world as "Non-fungible Tokens" (NFT). Built on essentially the same blockchain infrastructure, artists have sold digital artworks at (sometimes), astronomical prices. For example, Beeple’s “Everydays: The First 5000 Days” was purchased for $69 million by a single investor, while the "Merge" was purchased by a group of collectors for $91.8 million (yes, million). Below, is a screen shot of the first known NFT, Quantum, created by Kevin McCoy and Anil Dash in May 2014.

Kevin McCoy, "Quantum" (2014), non-fungible toke (image courtesy of Sotheby's)