\ ˈlan-ˌyap , lan-ˈyap \

: a small gift given to a customer by a merchant at the time of a purchase; broadly : something given or obtained gratuitously or by way of good measure

Sea sampler Kathleen Reardon aboard Khristy Michelle, East Penobscot Bay. Photographed by Travis Dove, 2011.

Invest Like Lobstermen

Successful lobstermen, like investors, think long-term. In the photo above, a recently trapped lobster isn't large enough or is an egg-bearing female, so it is returned to the sea as an "investment" in the future harvest. This is one of many proven principles we can follow as investors (and lobstermen).

This newsletter is a continuation (and antidote) to last month's topic "Hype = Headache." Read on to enjoy timeless wisdom that will help you invest with purpose and peace.

Investing Wisdom

"It isn't investments that make or lose money, it's investors."

As I was preparing my thoughts for this newsletter, I read the above quote by Wall Street Journal finance author Jason Zweig (The Intelligent Investor, 26 Oct 21). He perfectly summarized the most important truth about investing: success is more about "who" than it is about "what." The investor needs to understand themselves (goals, risk tolerance, timeline, etc.), before they begin investing. Far too often investors place their focus on the "what" without considering the "who."

The Fundamentals

Investing with wisdom requires understanding the basics. Here are the top seven considerations:

Economic Context

All investing occurs within a greater financial context. Here are the enduring truths about that environment:

Worldly Perspective

Let's also consider the opposite of wisdom: foolishness. Here's what the world (news, social media, sales people, etc.), says about how to be financially successful:

Remember, if it sounds too good to be true, it probably is.

Investing Wisdom

Do you have questions about investing? Schedule yourself for a meeting so we can discus investing and develop a highly personalized plan that meets your specific needs.

Laissez les bons temps rouler

Mary's Recipe Corner

Enjoy this seasonal recipe from Mary’s Dad:

Papa Timmy’s Apple Mallow Yam Yums

My father, who our kids refer to as Papa Timmy, has been making this dish for Thanksgiving and Christmas as far back as I can remember. Our youngest daughter now has the job of making them anytime we are not at my parents' for the holidays. Last year she asked her Papa to write out and send her the recipe, instead of the dictated recipe I had written down. It was then that we found out that the “Sweet Potato” recipe came from a newspaper and was actually called “Apple Mallow Yam Yums.” We think the name makes them taste even better. 😉

2 green apples, peeled and sliced like you would for a pie

1/3 cup chopped pecans

1/2 cup brown sugar

1/2 tsp cinnamon

1-1/2 pound sweet potatoes (peeled, cubed, and cooked tender in water)

1/4 cup butter

2 cups mini marshmallows

Combine apples, pecans, brown sugar, cinnamon, and sweet potatoes. Place in casserole dish. Dot with butter. Bake at 350 for 35-40 minutes. Cover with marshmallows and return to the oven just long enough to brown the top (watch closely as it will burn quickly).

Bon appétit!

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it's appropriate to share a bit of art with our readers.

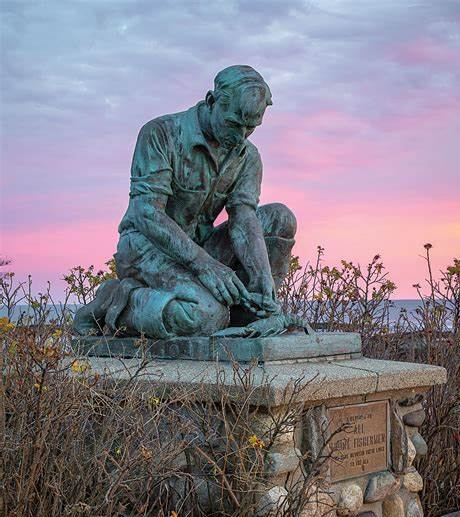

It seems fitting to honor lobstermen and their "investing" mindset. The statue below, by sculptor Victor Kahill, is a memorial to "All Maine fishermen who have devoted their lives to the sea." What is especially interesting about this statue is that one of the three copies is found on the wharf in Washington, DC. I discovered it the last time I was shopping for gumbo ingredients. The sculptor, sculpture, and model have a long and colorful history that you can enjoy HERE.

The Maine Lobsterman, Victor Kahill, 1939