\ ˈlan-ˌyap , lan-ˈyap \

: a small gift given to a customer by a merchant at the time of a purchase; broadly : something given or obtained gratuitously or by way of good measure

Pine Point, Scarborough, Maine. By Ed Fletcher; submitted to "Down East Magazine.

How's Your Timing?

When I think back to our childhood visits to Maine, I recall being fascinated by the dramatic coastal tides. I was amazed by how the lobster boats were transformed from hearty seagoing vessels, to beached "wrecks" in just a few hours. I learned quickly that if you wanted to use your boat, you had to understand that time can either be your ally or adversary. Similarly, as long-term investors, we need to understand the value of time versus timing.

Time, Not Timing

In financial planning, there are many words of wisdom that offer keen insight shaped by (often painful) experience. These wise words from professionals and amateurs alike can teach investors how to be successful and avoid costly mistakes. Here are a few favorites:

This last quote instructs investors to stay invested and not attempt to anticipate what the markets will do next. More broadly, investors must consider the overall timeline of their plan, and then honor it. Too many people get swept up in the headlines or the latest fad, and lose sight of their original timeline. This is especially true when markets become volatile.

A common mistake investors make during volatile markets is to sell their holdings following a notable drop in value. They believe they are avoiding damage to their portfolio, but may actually sell at a significant loss in value. The greater damage can occur in their delayed return to the markets. Investors rarely get back in the market soon enough to experience the recovery. By the time they reinvest, it's probably too late.

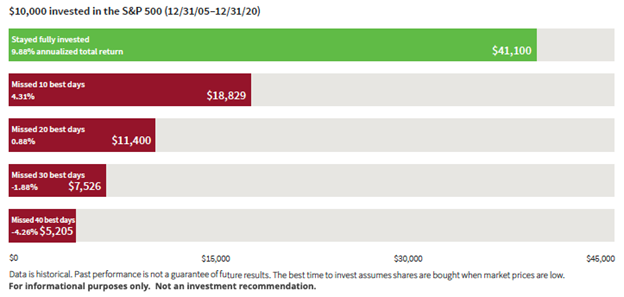

Carefully review the chart below from Putnam Investments. It shows that by staying fully invested over the past 15 years, you would have earned $22,270 more than someone who missed the market's 10 best days. That's just 10 out of nearly 4,000 trading days, or approximately 0.25% of the total market time.

Point: Focus on your time in the market, not on trying to time the market. The long-term investor will be rewarded for their patience.

Want to talk about your investments and timeline? Schedule yourself for a meeting so we can build a successful plan that uses time as your ally, not your adversary.

Laissez les bons temps rouler

Mary's Recipe Corner

Enjoy one of my wife's all-time favorite recipes:

Pineapple Coleslaw

This is a simple side dish that our son really likes. Something about the sweet pineapple works well with the crunchy cabbage and sweet/tangy dressing, making it a bit different than traditional coleslaw.

3/4 cup mayonnaise

2 TBSP vinegar

2 TBSP sugar

1-2 TBSP milk

4 cups shredded cabbage

1 can (8 ounces) pineapple tidbits, drained

Combine mayo, vinegar, sugar, and milk. Toss with cabbage and pineapple just before serving. Can sprinkle with paprika. Serves 8.

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it seems appropriate to share a bit of art with our readers.

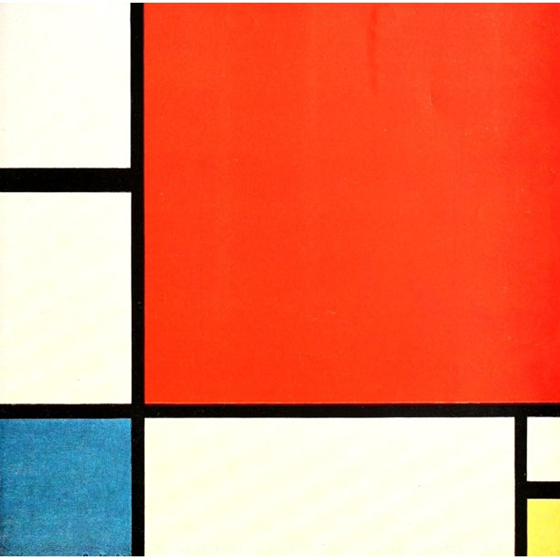

Piet Mondrian (1872-1944), was a highly influential Dutch painter who is considered one of the greatest artists of the 20th century. Although he started as a realistic landscape painter, he became more widely know for his abstract work with lines and primary colors.

His art graced the cover of my Discrete Mathematics textbook in college. These classes were extremely difficult, so I promised myself that if I survived, I would have a framed Mondrian print. It reminds me that great success comes from even greater perseverance. You can learn more about Piet Mondrian HERE.

"Composition II", Piet Mondrian, 1929. National Museum, Belgrade, Serbia