\ ˈlan-ˌyap , lan-ˈyap \

: a small gift given to a customer by a merchant at the time of a purchase; broadly : something given or obtained gratuitously or by way of good measure

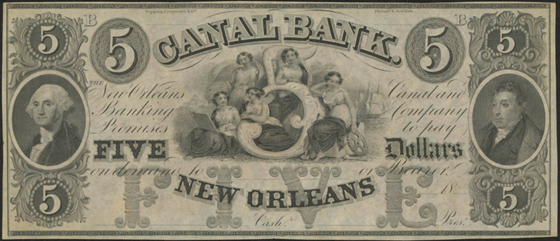

New Orleans Canal and Banking Company Promissory Note, 19th century

Tax = Wealth

The history of US currency includes vast varieties of city/state/regional issues, colorful artwork and intense political turmoil. It is one of the more fascinating topics you can study (as a financial advisor anyway).

However dynamic the topic, one constant is the distaste we have for paying taxes. It always seems to be too much, and it is spent on the wrong things. I will not digress into that discussion, but instead will encourage you to think about taxes as a measure of wealth. Are your taxes complex and the amount owed surprisingly large? Congratulations, you are doing well financially. Taxes really are a measure of prosperity, so keep that in mind as you complete your return and read the following Tax Tips.

NOTE: Because of its strategic location, New Orleans was once the home of one of the largest US Mints. The building is now theNew Orleans Jazz Museum.

Tax Tips and Planning for 2021 and 2022

Due Date: Most federal tax returns are due Monday, 18 April 2022. Why is this? Friday, 15 April is a holiday in Washington, DC.

Standard Deduction: As with many parts of the tax code, the standard deduction is adjusted for inflation. For single filers: $12,550, for married: $25,100.

Withholding: This gets a lot of attention each year. Did you owe or maybe received "too much" of a refund? Now is a great time to adjust your withholding for 2022. The IRS has a superior withholding calculator HERE. Have all of your normal tax documents handy when you begin.

Stimulus, stimulus, stimulus: There were three rounds of Economic Impact Payments. These were mostly advanced payments of a fully refundable tax credit. Although not taxable, it can impact your return, so look for a letter from the IRS which summaries your 2021 payments.

Child Tax Credit: Nothing has changed more or caused more confusion than the new / changed child tax credit (CTC). The American Rescue Plan significantly expanded the child tax credit, pumping up its maximum value and allowing families to receive advance payments for six months. But those payments only represented half of the child tax credit. To get the other half of the money, families have to file their taxes. If you received advance CTC payments, the IRS should have mailed you Letter 6419 listing how many eligible children you have and how much money you got for them. Use this information to claim remaining child tax credit funds on your return.

Charitable Donation: Again, newish for 2021 (and not planned for renewal in 2022), taxpayers who do not itemize can still claim a charitable donation deduction. For single filers it is $300 and married filing joint it is $600. NOTE: The cash-only donation(s) had to occur in 2021.

Ways to Save on 2021 Taxes: Yes, you still have time to save on last year's taxes (if you qualify).

Estate and Gift Tax: The federal estate- and gift-tax exemption applies to the total of an individual’s taxable gifts made during life and assets left at death. Above the exemption, the top rate on such transfers is 40%. For 2021, the lifetime exemption for both gift and estate taxes was $11.7 million per individual, or $23.4 million per married couple. For 2022, an inflation adjustment has lifted it to $12.06 million per individual, or $24.12 million per couple. NOTE: These increases will lapse in 2025.

Cryptocurrency: Crypto owners should be aware that the IRS is trying to strip away excuses for millions of people who are not complying with the tax rules, either inadvertently or intentionally. The agency has put a pointed question on the front page of the Form 1040: At any time during 2021, did you receive, sell, exchange or otherwise dispose of any financial interest in any virtual currency? Answer honestly.

529 Education-Savings Accounts: Named after a section of the tax code, 529 accounts allow savers to contribute after-tax dollars toward education expenses. Withdrawals from these accounts are tax-free if they are used to pay eligible education expenses such as college tuition, books, and often room and board. The 529 plan is offered directly by states or "surrogate" investment firms, and all states and the District of Columbia have them. More than 30 states offer a tax break for contributions.

Qualified Charitable Distribution: This popular benefit allows retirees who are 70.5 or older to donate IRA assets up to $100,000 directly to one or more charities and have the donations count toward their required annual payout. For IRA owners who give to charity, this is often a tax-efficient move. Donors can take the standard deduction and still receive a tax break for their giving. While there is no deduction for gifts of IRA assets, the withdrawal does not count as taxable income. This can help reduce Medicare premiums that rise with income and taxes on other investment income, among other things. However, these transfers cannot be made to a donor-advised fund. Givers should also make sure they account for the charitable transfer on their tax return. IRA sponsors typically record the gross withdrawal on the 1099-R, not the net amount after the donation.

Suffice to say, we ran out of space before we ran out of Tax Tips. Do you have questions about your taxes or your financial plan? Schedule a meeting so we can discuss and develop a highly personalized plan that meets your specific needs.

Laissez les bons temps rouler

Mary's Recipe Corner

Enjoy this family recipe from Mary:

Million Dollar Cookies

On name alone, these needed to be in a financial newsletter! 😉

My Mom made these often when I was a kid. The recipe comes from a friend of my Grandmother. Although the ingredients are fairly basic they come together to make a very good cookie. Hope you enjoy!

Cream shortening and sugars. Add egg and vanilla. In a separate bowl mix dry ingredients and then add to the shortening mixture. Stir in nuts. Form into balls and roll in the bowl of sugar. With the bottom of a cup press the dough balls down to flatten a bit. (A cut glass pressed into the dough makes a pretty cookie.) Bake at 350 for 10-12 minutes.

Blessings and bon appétit!

Mary

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it's appropriate to share a bit of art with our readers.

Jan Sanders van Hemessen painted several compositions of the Calling of St. Matthew which allowed him touse a religious subject to convey a moral message. Matthew began his life as a publican until he was called by Jesus. Matthew immediately followed Him. The scene contrasts people busily engaged in commercial activities, in particular money changing or counting, and the serene Jesus. The figure of Matthew is a concealed portrait of Emperor Charles V, the then ruler of Flanders.

Calling of St. Matthew, Jan van Hemessen, 1540