Tax = Wealth

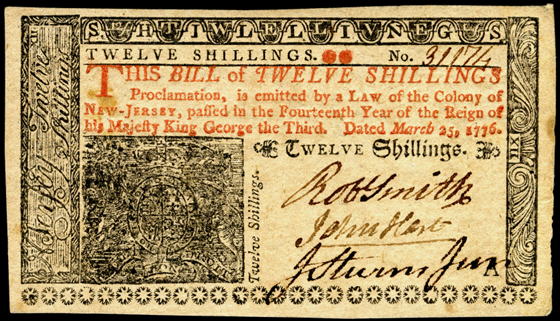

The history of US currency is fascinating in its design, production, and use. The image above is of New Jersey currency printed by Founding Father Benjamin Franklin. From 1731 to 1764, Franklin printed millions of dollars in currency for various states. I suspect he would enjoy the irony of seeing himself on our one-hundred dollar bill.

However dynamic the topic, one constant is the distaste we have for paying taxes. It always seems to be too much, and it is spent on the wrong things. I will not digress into that discussion, but instead will encourage you to think about taxes as a measure of wealth. Are your taxes complex and the amount owed surprisingly large? Congratulations, you are doing well financially. Taxes really are a measure of prosperity, so keep that in mind as you complete your return and read the following Tax Tips.

Tax Tips and Planning for 2022 and 2023

Due Date: Most federal tax returns are due Tuesday, 18 April 2023. Why is this? Monday, 17 April is a holiday in Washington, DC.

Standard Deduction: As with many parts of the tax code, the standard deduction is adjusted for inflation.

• 2022: For single filers: $12,950 / For married: $25,900

• 2023: For single filers: $13,850 / For married: $27,700

Tax Withholding: This gets a lot of attention each year. Did you owe or maybe received "too much" of a refund last year? Now is a great time to adjust your withholding for 2023. Make an appointment (after you upload a recent pay check), and we will run an accurate projection for you.

• Tip for Kids: If your kids have a job and expect to earn below the standard deduction, they should consider having a "$0" tax withholding. This may allow them to avoid filing a return. Same for state withholding.

Child Tax Credit: In recent years, nothing has changed more or caused more confusion than the child tax credit (CTC). All that is finally behind us. For 2022 and 2023, the full amount is $2,000. There are income limitations, but they are quite generous.

Charitable Donation: No significant changes here. Note that the previous "front page" donation deduction in 2020 and 2021 is not available for tax year 2022 or 2023.

Ways to Save on 2022 Taxes: Yes, you still have time to save on last year's taxes (if you qualify).

• Contribute to a Traditional IRA: Save up $6,000 or $7,000 for those age 50+, before 18 Apr (and before you submit your return). There are limits based on income, so discuss this with your advisor.

• Contribute to an HSA: Health Savings Accounts are "triple tax free" if used correctly. You can still make 2022 contributions of up to $7,300 for families and $3,650 for singles (add $1,000 if age 55+).

• Contribute to a SEP IRA: People with self-employment income can often contribute up to $61,000. Deadline for setting up and contributing is 15 Oct 2023 (if you file a six-month extension).

• Save on Penalties: Not ready to file by 18 April and did not withhold enough? Be sure to make a payment anyway to avoid or lessen the penalty. See: IRS.gov/Payment for details.

Estate and Gift Tax: The federal estate and gift-tax exemption applies to the total of an individual’s taxable gifts made during life and assets left at death. Above the exemption, the top rate on such transfers is 40%. For 2022, the lifetime exemption for both gift and estate taxes was $12+ million per individual, or $24+ million per married couple. For 2023, an inflation adjustment has lifted it to $12.9 million per individual, or $25+ million per couple. NOTE: These increases will lapse in 2025.

• 2022 Annual Gift-tax Exemption: $16,000 ($32,000 for couples)

• 2023 Annual Gift-tax Exemption: $17,000 ($34,000 for couples)

Cryptocurrency: Crypto owners should be aware that the IRS is trying to strip away excuses for millions of people who are not complying with the tax rules, either inadvertently or intentionally. The agency has put a pointed question on the front page of the Form 1040: At any time during 2022, did you receive, sell, exchange or otherwise dispose of any financial interest in any virtual currency? Answer honestly.

529 Education-Savings Accounts: Named after a section of the tax code, 529 accounts allow savers to contribute after-tax dollars toward education expenses. Withdrawals from these accounts are tax-free if they are used to pay eligible education expenses such as college tuition, books, and often room and board. The 529 plan is offered directly by states or "surrogate" investment firms, and all states and the District of Columbia have them. More than 30 states offer a tax break for contributions. Note: tax deductible contributions must be made in calendar year 2022 to receive the deduction when you file.

Qualified Charitable Distribution: This popular benefit allows retirees who are 70.5 or older to donate IRA assets up to $100,000 directly to one or more charities and have the donations count toward their required annual payout. For IRA owners who give to charity, this is often a tax-efficient move. Donors can take the standard deduction and still receive a tax break for their giving. While there is no deduction for gifts of IRA assets, the withdrawal does not count as taxable income. This can help reduce Medicare premiums that rise with income and taxes on other investment income, among other things. However, these transfers cannot be made to a donor-advised fund. Givers should also make sure they account for the charitable transfer on their tax return. IRA sponsors typically record the gross withdrawal on the 1099-R, not the net amount after the donation.

Suffice to say, we ran out of space before we ran out of Tax Tips. Do you have questions about your taxes or your financial plan? Schedule a meeting so we can discuss and develop a highly personalized plan that meets your specific needs.

Laissez les bons temps rouler

Mary's Recipe Corner

Enjoy this family recipe from Mary:

Lemon Raspberry/Blueberry Pancakes

A Jensen family tradition was that the first day of school always started with a pancake breakfast. This recipe was for our youngest's first day of kindergarten, and it comes out of my well-worn, pages falling out, batter-splattered pancake cookbook by Dorie Greenspan. I owe her for many delicious mornings.

• 1 cup flour

• 1/3 cup sugar

• 1-1/4 tsp baking powder

• Pinch of salt

• Zest of one lemon

• 1 cup milk

• 1 egg

• 3 TBSP unsalted butter, melted

• 1 tsp vanilla

• 1/2 tsp lemon extract, or add more lemon zest

• Three handfuls of either raspberries or blueberries

Combine all the dry ingredients in one bowl and wet ingredients in another, leaving out the berries. Pour the dry into the wet, and gently stir together, being careful to not over mix. Pour batter on greased griddle (350 degrees). When bubbles form on the topside, add a few berries to each pancake and flip them over. Cook on second side until golden. Serve with LOTS of real maple syrup. The last line is Bill's contribution to the recipe. 😉

Blessings and bon appétit!

Mary

[email protected]

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it's appropriate to share a bit of art with our readers.

Famous late designer, Karl Otto Lagerfeld (1933 - 2019), had an interesting take on taxes. He said, "Luxury is the income tax of vanity. But it is so pleasant." It took me a moment to fully ponder the depth of this statement, but it rings true when you consider how excessive spending (luxury) is a "tax" on your finances. However, I am certain no one will suggest that taxes are "pleasant."

The sketch below is from his early years (1964) prior to his long tenures at many famous fashion brands. You can already see the classic style he would use to revive Chanel in the 1980s.