The Most Remote Location

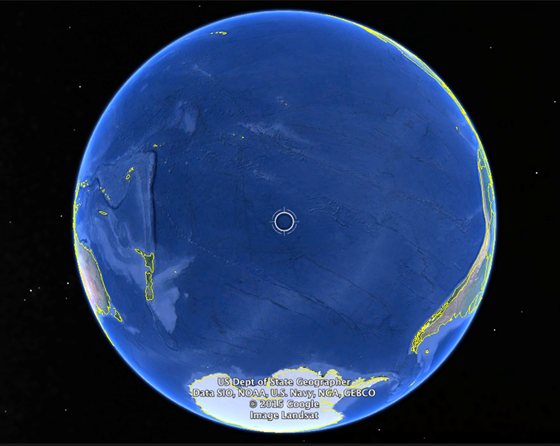

The most remote place on Earth is Point Nemo. It is a point located in the South Pacific and is considered the place of greatest inaccessibility because the closest landmass is more than 1,600 miles away. The name is a reference to Captain Nemo of Jules Verne's Twenty Thousand Leagues Under the Sea. This location is so remote that sometimes the closest humans are astronauts in the International Space Station.

That level of remoteness would make any sailor feel uncertain about their fate if something dire were to occur. The near total inaccessibility could make us feel tiny and incredibly vulnerable. Sometimes, our finances, the banking system, or the markets can also make us feel this way. A clear-minded, successful investor knows that this uncertainty is certain.

In a letter to Jean-Baptiste Le Roy, Benjamin Franklin wrote, "Our new Constitution is now established, and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes." If I could add to this idiom, it would be to include the word "uncertainty." So, death, taxes, and uncertainty are certain. The unsettling events in the banking sector over the last couple of weeks are clear proof of this truth. What can an investor do in such a situation?

Investing in Uncertain Times

There is an old adage that says, "the only constant is change." This is especially true with investing, world events, and our own personal lives. Nothing stays the same, at least not for very long.

Ironically, we are surprised, sometimes shocked, when things change. I will save my thoughts on why this is for another day, but as a financial planner, I have the responsibility of ensuring that Clients are prepared for when the markets and life change. How do we do this?

Step I: Determine the Goal and the Timeline

Every Client needs to establish for themselves two things for each investment account: 1) the goal, and 2) the timeline. The goal may be retirement with a timeline of 30 years, or it may be for a down payment on a home planned for next year. These are vastly different goals and timelines, which highlights the critical importance of this first step.

Step II: Risk Tolerance Survey

At Acadia, all Clients complete an eight-question Risk Tolerance Survey which walks them through both objective and subjective self-assessments that ultimately result in a numerical score. That score leads us to a stock / bond ratio (also called an allocation) for the investment account.

Note: The type of account can vary (such as 401k / 403b / 457, an IRA, or an investment account), but the pivotal nature of the goal and timeline is universal.

Step III: Apply, Revisit, and Maybe Revise

This stock / bond ratio (allocation) is then applied to the account and monitored. When necessary, perhaps annually, the account is rebalanced to maintain the desired allocation (and commensurate risk tolerance). However, over time, the goal and/or timeline may change. Perhaps a Client retires early, or has decided to try semi-retirement. Maybe the Client decides to not buy a home for a few more years. There are as many possible changes as there are Clients! Regardless of the reason, Clients revisit their Risk Tolerance Survey to possibly recalibrate their sensitivity to risk. If there is a change, we revise the allocation and apply it to the account.

This 'apply, revisit, revise' cycle never ends, which makes sense when you consider that your timeline is always changing.

Step IV: Trust the Process

Have I made this all sound too easy? Unfortunately, what normally happens along the way is some significant world event or market turmoil creates anxiety and unease. It can cause people to forget their long-term goals and become overly focused on the short-term crisis. At times like this, we have to trust the process. When we remember that the Risk Tolerance Survey includes questions about volatility, timeline, and loss tolerance, it can calm our nerves and help us avoid costly mistakes.

Step V: Invest with Wisdom

Lastly, as a bit of a refresher, the following are a few key components of the Acadia Investment Wisdom Statement.

The Fundamentals

Investing with wisdom requires understanding the basics. Here are the top seven considerations:

• Investments are a tool and not an end

• Time is your friend

• Know when to invest

• Know why to invest

• Know where to invest

• Know what to invest in, based on your goals

• Know how to invest

Economic Context

All investing occurs within a greater financial context. Here are the enduring truths about this environment:

• Economic uncertainty is certain

• Economic prosperity is certain in retrospect

• Economic cycles are normative

• The future is unpredictable

Worldly Perspective

Let us also consider the opposite of wisdom: foolishness. Here is what the world (news, social media, sales people, etc.), says about how to achieve financial success:

• Get rich quick

• Short time horizon (time is an enemy)

• Spend and consume first

• Expect upward trends always

• There's a secret to investing success

• If you buy this (fill in the blank with any sales pitch), you're guaranteed to be rich

Remember, if it sounds too good to be true, it probably is.

Investing Wisdom

• Recognize that God owns it all. Psalm 24:1 says, “The Earth is the LORD’s and everything in it; the world and all its people belong to Him.”

• Establish a Financial Plan. Before you can invest wisely, you must have an overarching plan to achieve your goals.

• Manage Cash Flow. Before you spend any income, decide how you will save or invest for your future. This is a parallel to the adage, "pay yourself first." Do not allow discretionary income to steal your dreams.

• Establish an Emergency Fund. If you are not financially prepared to withstand a financial emergency, then you are vulnerable to disaster. Start small, but be consistent, until you eventually have enough to cover 3-6 months of living expenses.

• Understand Your Risk Tolerance. Do stocks make you nervous, or are you a day trader? Understanding where your anxiety level rests in investing is critical to peaceful planning.

• Think Long Term. Always plan with the long view in mind. This even includes your decisions about cash. What are your long-term goals and needs? Determine those and then develop your short term (cash) positions to achieve these goals. Thinking long-term also allows you to ignore the latest investing craze.

• Diversify. This is the opposite of "putting all your eggs in one basket." Diversification includes the investments but should reflect time period, asset class, and geography.

• Always Count the Cost. Investing is not free. Ensure you know how much the index fund, mutual fund, etc., is costing you. Fees matter and have a long-term impact on performance.

• Understand Taxes. Ordinary income isn't just for your wages. It can also be found in certain investments, along with capital gains (both investments and real estate), Net Investment Income Tax, wash sale tax, interest and dividends.

• Manage Your Emotions. When the news, world events, politics, or even a coworker's latest "hot stock tip" cause you some anxiety, simply pause, review your plan, and remember your long-term goals. Investing peace comes from having a long-term strategy and sticking to it.

• Giving Breaks the Power of Money. Although point #1 reminds us that God owns everything, these words only have power if we are generous with others. This includes, the church, supporting ministries of various kinds, and the needy.

• Seek Wise Counsel. Consulting with a professional investment manager will help the Client make a fully informed decision. There are simply too many variables, too much complexity, and not enough time to stay proficient on your own. Life only gets more complicated.

Investing wisely is always a challenge, even in the most accommodating markets. Do you have questions about investing or your financial plan? Schedule a meeting so we can discuss investing in an uncertain world.

Laissez les bons temps rouler

Mary's Recipe Corner

Enjoy this family recipe from Mary:

Oatmeal Bread

This recipe comes from my Mother, who made this several times when I was growing up. The bread is very flavorful, and it is even better when toasted and topped with butter.

• 2-1/4 cups boiling water

• 1 cup oatmeal (5 minute oats- not quick oats)

• 1 TBSP butter

• 2 tsp salt

• 1/3 cup sugar

• 1/2 cup dark Karo syrup

• 2-1/4 tsp active dry yeast

• 6 cups flour (less, as this never takes the full 6 cups)

Pour boiling water over oatmeal, and let sit 1 minute. Add butter, stir until melted. Add salt, sugar, and Karo. Let rest until temp reaches 110. Sprinkle the yeast over the batter and let stand 5 minutes, until bubbly. Stir in 2 cups of flour until well combined. Add flour 1/2 cup at a time to make a sticky dough. Knead until fairly smooth, adding flour as needed.

The dough should form a ball. Place dough ball in a greased bowl to rise. Cover bowl with a flour sack towel and let rise in a warm spot until doubled in size. This will take an hour, plus.

Form into two loaves. I do this by flattening out the dough so it is about 1/2 inch thick, but keeping it the width of the pan. Then I tightly roll it up like a jelly roll and place it seam side down in the well greased bread pan.

Cover both loaves with the flour sack towel and let rise in a warm spot for another hour. Bake 375 for 35 minutes, until internal temperature reads 180. (I like to take the temperature going through just above the edge of the pan to the middle of the loaf, so it doesn't leave a hole on top of the loaves. Cool on racks. Freeze any bread you won't eat within a few days.

Blessings and bon appétit!

Mary

[email protected]

For Art's Sake

If you grow up in New Orleans you learn to appreciate art (and food and music and parades, etc.), so it's appropriate to share a bit of art with our readers.

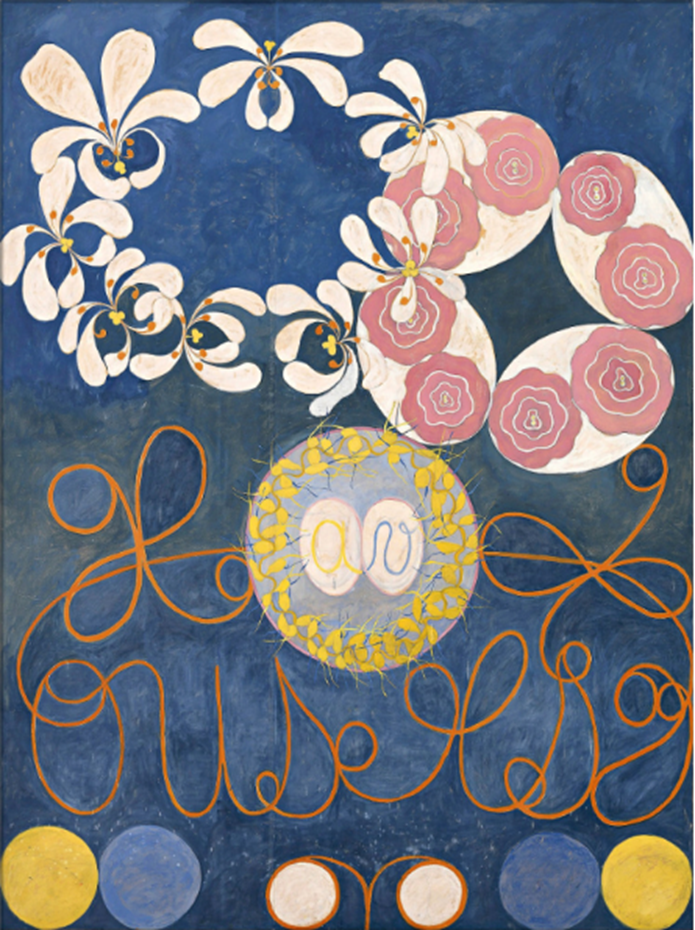

It seems appropriate with the topic of uncertainty that we should consider abstract art. Hilma af Klint, (1862- 1944), was a Swedish artist whose paintings are considered among the first abstract works in Western art history.

She inherited an interest in mathematics and botany from her family. This, along with her artistic ability, blossomed after the family moved to Stockholm, where she studied at Tekniska skolan in Stockholm (Konstfack today).

Her conventional painting was the primary source of income, but her 'life's work' remained a very different practice. The print below is from her series entitled, 'The Ten Largest.'